Exclusive from the Current HANSA Yachts Magazine:

After the peak of the pandemic, the superyacht market is showing signs of cooling. Nevertheless, well over 1,000 yachts are currently under construction or on order.

While some brokers from major brokerage houses report a decline in buyer interest due to global economic uncertainty, the superyacht industry overall remains stable. In particular, the new-build segment continues to perform strongly when viewed over the past five years. In 2021, 180 shipyards active in superyacht construction had 820 yachts under construction or on order. This number increased to 1,000 in 2022, and even reached 1,200 in 2023. This rapid growth was largely fuelled by the COVID-19 pandemic, as many saw yachts as safe havens. By 2024, the number had slightly decreased to 1,170 yachts, and for 2025, 1,130 projects are currently in the pipeline.

Italy leads the way

Italy leads the way

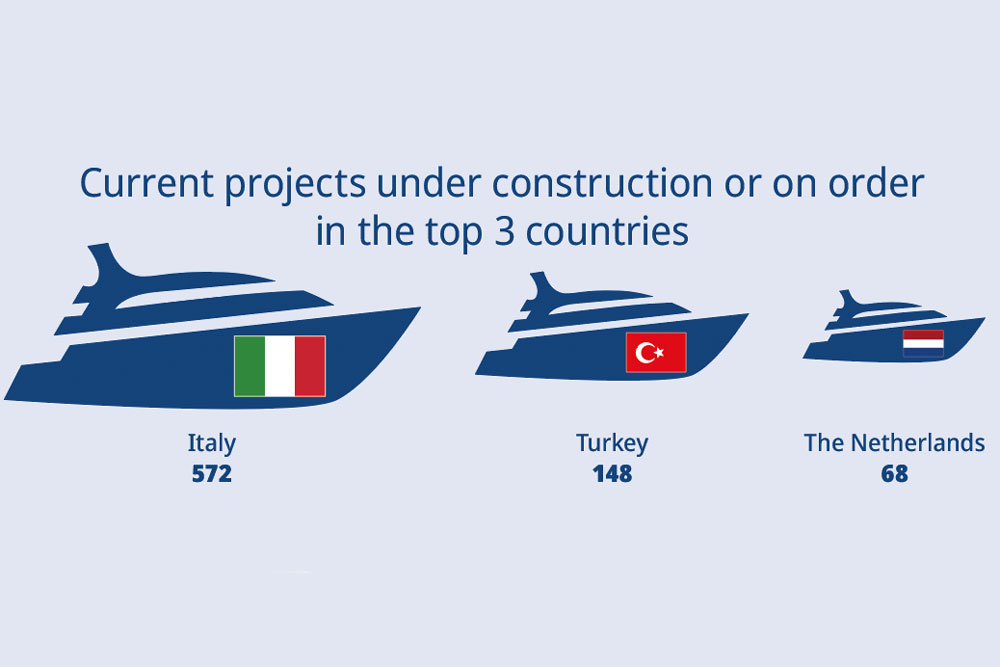

Italy remains the leading country, with 572 projects under construction or on order. These yachts collectively measure 22 kilometres, with an average length of 38.5 metres. Turkey follows in second place, with 148 projects totalling 6,400 metres—an average of 44 metres per yacht. The Netherlands ranks third, with a notably high average yacht length of 65 metres, across 68 projects and a combined length of 4,500 metres.

The UK and Taiwan are nearly tied for fourth and fifth place, although Taiwan’s average yacht length of 30.8 metres is about four metres longer than that of the UK.

Altogether, the total length of all superyachts currently under construction or on order amounts to approximately 45 kilometres.

As in previous years, the top shipyards are based in Italy. Azimut-Benetti holds the leading position, with 5,900 metres of yachts under construction or on order. Sanlorenzo follows with 4,400 metres, and Feadship comes third with 1,500 metres. The Italian Sea Group ranks fourth with 1,350 metres, while Lürssen takes fifth place with 1,250 metres.

Trends by size category

Demand for yachts up to 45 metres in length has slightly declined. This segment still represents the majority of the market, with 850 projects, but this is around 60 fewer than in 2024. By contrast, the 45- to 60-metre segment has grown, with 18 more yachts under construction compared to last year.

The number of sailing yachts remains steady. Currently, 70 sailing yachts over 24 metres in length are under construction or on order worldwide. The few shipyards active in this segment—such as Royal Huisman, Vitters, Nautor Swan, Baltic, Southern Wind, and Solaris—may see greater opportunities in the future, especially as sustainability becomes more important in the yachting industry.

Generation Z is also emerging as a potential customer group and is already influencing family yacht purchases.

A sign of this shift: 90 of the 1,130 current projects will feature alternative propulsion systems, either hybrid or fully electric.

For buyers interested in joining an ongoing project, there are many possibilities. Around 30 per cent of all yachts are being built on speculation, meaning they do not yet have a specific client. For buyers, this often means shorter delivery times and, in some cases, more competitive pricing. MK